Blooming Market Insights

Explore the latest trends and insights in digital marketing.

Valuations After Market Drop: Finding Gems in the Rubbles

Discover hidden investment gems after the market drop! Learn how to spot undervalued stocks and maximize your returns today.

Identifying Undervalued Assets: A Guide to Investing After Market Corrections

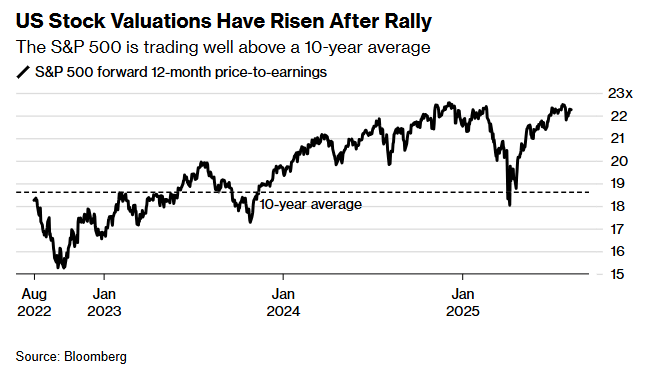

Market corrections can create an opportune environment for savvy investors looking to identify undervalued assets. During these periods, stock prices often dip due to factors like economic downturns, fear, or market speculation, leading many investors to liquidate their positions and miss potential opportunities. To capitalize on these situations, it’s essential to conduct thorough research by analyzing financial metrics, comparing them against industry peers, and assessing the company’s fundamentals. Tools such as discounted cash flow analysis and price-to-earnings ratios can help in recognizing assets that may be trading at a discount.

Once you have identified potential undervalued assets, consider the following steps to refine your investment strategy:

- Stay informed: Keep up-to-date with market news, trends, and economic indicators that could impact your selected assets.

- Diversify your portfolio: Diversification can mitigate risk. Spread your investments across different sectors to safeguard against sector-specific downturns.

- Be patient: Investing is a long-term game. Even after identifying undervalued assets, it may take time for the market to recognize their true value.

Counter-Strike, a popular first-person shooter game, has seen numerous updates and adaptations over the years. Players often engage in a vibrant skin market recovery that adds an additional layer of enjoyment and investment to the gameplay experience. The competitive scene remains one of the most active in esports, attracting players and spectators alike.

How to Navigate Market Volatility: Strategies for Finding Value in Downturned Markets

Navigating market volatility can be challenging, especially during downturns when investor sentiment is often cautious. However, there are several strategies that can help you find value in downturned markets. First, consider conducting thorough fundamental analysis on potential investments. Look for companies with strong balance sheets, consistent cash flow, and a proven track record of weathering economic storms. By focusing on long-term growth prospects rather than short-term fluctuations, you can identify opportunities that others may overlook.

Another effective strategy is to diversify your portfolio to mitigate risk. During times of market volatility, it is crucial to spread your investments across different asset classes such as equities, bonds, and commodities. Additionally, consider incorporating defensive stocks in sectors like healthcare and consumer staples, which tend to perform better during economic slowdowns. Lastly, always keep an eye on market trends and macroeconomic indicators to make informed decisions that align with your investment goals.

What to Look for in Undervalued Stocks: Tips for Investors After a Market Drop

Investing in undervalued stocks after a market drop can be a savvy move for investors looking to capitalize on potential gains. First, consider the company's fundamentals; look for a strong balance sheet with low debt levels and a history of consistent revenue and earnings growth. Additionally, evaluating the price-to-earnings (P/E) ratio in comparison to industry peers can reveal stocks that are trading at a discount. Beyond financial metrics, it’s essential to assess the company's competitive position within its sector and its growth prospects, as these factors significantly influence long-term value.

Another critical aspect to examine is the market sentiment surrounding the stock. Sentiment can drive prices down to irrational levels during market dips, providing a unique opportunity for investors. Utilize tools such as investor presentations, earnings calls, and news articles to better understand market perception. Keeping an eye on insider buying can also be a positive signal; when insiders invest in their own company, it often reflects confidence in future performance. Overall, by focusing on fundamentals while being mindful of market sentiment, you can identify undervalued stocks that have the potential to rebound significantly.